● 통화지표

통화지표란 통화신용정책의 최종목표를 달성하기 위하여 통화신용정책의 최종목표 변수에 중요한 영향을 미치면서도 최종목표 변수보다는 더 직접적으로 통화당국이 영향을 미칠 수 있는 경제변수

통화신용정책의 메카니즘

| 정책수단 (Policy Instrument) |

조작목표 (Operating Target) |

중간목표 (Intermediate Target) |

최종목표 (Ultimate Target) |

|||

| 공개시장조작 지급준비율 재할인정책등 |

→ | 본원통화 재할인금리 |

→ | 통 화 량 시장금리 |

→ | 성 장 물 가 국제수지 |

□ 통화정책 지표를 선택할 경우에는 이자율과 통화량등 양적금융지표 중에서 어느쪽을 선택할 것인가 하는 문제가 따르는데

ㅇ 우리나라는 1957년부터 재정안정계획을 수립·집행하면서 통화량을 통화정책 지표로 채택해 왔음

□ 통화량을 통화정책 지표로 할 때 어떤개념의 통화량을 선택할 것인가 하는 문제는

ㅇ 통제가능성, 최종목표와의 관련성, 계수파악의 신속·정확성등을 종합적으로 고려하여 판단하여야 함

● 주요 통화지표의 장단점 비교

| 구 분 | 구 성 | 평 가 |

| 본원통화 (RB) |

화폐발행고+지준예치 |

·통제가능성 및 속보성 우수 ·통화승수의 불안 등으로 중심지표 활용에 한계 |

| M1 |

현금통화+요구불예금 |

·통제가능성 및 속보성 우수 ·명목소득과의 안정성이 낮음 (특히 주식, 부동산시장 상황에 따른 저축성예금의 요구불예금화 추세 등으로 불안정성 높음) |

| M2 |

현금통화+요구불예금+저축성예금 |

·속보성 우수 ·명목소득과의 안정성이 높음 ·최근 금리자유화 진전 등으로 안정성이 다소 약화 |

| M2+CD | N2+CD | ·M2와 유사 |

| M2A |

M2-2년이상 장기저축성 예금 |

·통제가능성 및 속보성 우수 ·명목소득과의 안정성이 낮음 (장기예금으로의 이동 가능성) |

| M2B |

M2A+제2금융권 단기수신상품 |

·통제가능성 및 속보성 우수 ·장기예금 등으로의 이동 가능성 |

| MCT |

M2+CD+금전신탁 |

·속보성 우수 ·금전신탁에 대한 지준의무 부과문제등 발생 |

| M3 |

M2+제2금융권 수신상품 |

·명목소득과의 안정성이 높음 ·속보성 및 통제가능성이 낮음 |

● 통화지표의 종류

통화지표의 종류는 서로다른 금융기관에서 창출하는 다양한 기능과 성격을 가진 금융자산중 어디까지를 통화에 포함하느냐에 따라 구별

ㅇ 통화지표 구분시에는 통화지표에 포함시킬 금융자산의 범위와 대상금융기관의 범위가 함께 결정됨

● 통화지표의 편제방법

통화지표는 통화금융기관의 자산과 부채항목을 각각 통합하고, 상호거래를 상쇄하는 등 통화금융기관의 대차대조표를 통합하여 산출한 통화총량을 국민경제의 각 부문별 공급량을 파악하여 작성

ㅇ 현재 한국은행에서 작성하는 공식적인 확정 통화통계는 금융기관의 확정 대차대조표에 의하여 월 1회 작성되고 있음

Not all money is equal, as it circulates in different forms from cash bank notes to deposits in the bank which change the way it is valued and used. Here we break down how commercial and federal banks influence the money supply.

Money Supply

The money supply (or money stock) is the total value of money available in an economy at a point of time. There are several ways to define ‘money’, but standard measures usually include currency in circulation and demand deposits (depositors’ easily accessed assets on the books of financial institutions). Each country’s central bank may use its own definition of what constitutes money for its purposes.6

Commercial banks play a role in the process of money creation, especially under the fractional-reserve banking system. In this system, money is created whenever a bank gives out a new loan.

This new money makes up the non-M0 components in the M1-M3 statistics. In short, there are two types of money in a fractional-reserve banking system:

Central bank money: obligations of a central bank, including currency and central bank depository accounts

Commercial bank money: obligations of commercial banks, including checking accounts and savings accounts

The different types of money supply

The different types of money are typically classified as ‘Ms’. The ‘Ms’ usually range from M0 (narrowest) to M3 (broadest) but which Ms are actually focused on in policy formulation depend on the country’s central bank. The typical layout for each of the Ms is as follows:

M0: generally refers to the most liquid forms of money, i.e. currency in circulation. In some countries, such as the United Kingdom, M0 includes bank reserves, so M0 is referred to as the monetary base, or narrow money

MB: the monetary base or total c urrency. It generally covers all issued currency and bank reserves held at the central bank. This is the base from which all other forms of money less liquid than currency (like demand deposits, listed below) are created. As mentioned, it is not rare that M0 and MB carry the same meanings

M1: M0 plus some highly liquid assets such as demand deposits

M2: M1 plus ‘close substitutes’ for M1. M2 is a broader classification of money than M1 and a key economic indicator used to forecast inflation

M3: M2 plus large and long-term deposits

The process of money creation essentially creates money supply (M1, M2, M3) from the monetary base (MB). These measures can provide empirical estimates of money multipliers, which are simply ratios of money supply to the monetary base. They empirically reflect how far money spreads in the economy. Also, as we illustrate in the previous chapter, the further down the money hierarchy, the more the money is but also the worse the quality.

Open Market Operations

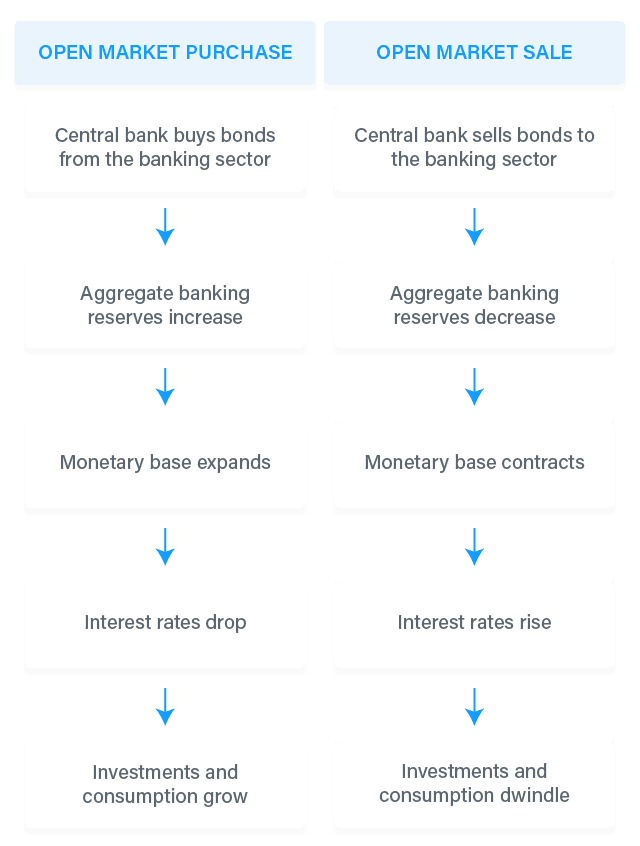

Central banks can influence money supply and interest rates by open market operations (OMO). Recall that money supply is created from the monetary base through the multiplier effect. As mentioned in the chapter about money creation, the required reserve ratio has a diminishing role in impacting the money supply. Then what is the key monetary tool used by central banks? While it is improbable to precisely control the multiplier effect, central banks almost have full control over aggregate reserves held by banks. And OMO is the most common policy used to manipulate the aggregate reserves and hence the monetary base.

OMO simply means purchases and sales of securities conducted by a central bank in the open markets. When the target is to raise money supply, a central bank purchases securities from the banking sector. The securities involved are usually government bonds like treasury bills. The term ‘open market’ refers to securities dealers competing on the open market based on price, submitting bids or offers to the central bank.

The central bank pays the banking sector by injecting the liquidity into the aggregate reserves deposited at the central bank. This can be understood as converting the securities held by commercial banks into liquid deposits at the central bank. These funds become available to commercial banks for lending, and by the multiplier effect from fractional-reserve banking, loans and bank deposits go up by many times the initial injection of funds into the banking system. In contrast, when the central bank ‘tightens’ the money supply, it sells securities on the open market, drawing liquid funds out of the banking system. The multiplier effect then leads to a contraction of the money supply.

Open market operations are influencing interest rates

Then you may wonder how OMO helps transmit its impact on interest rates. The most crucial interest rate impacting all economic activities is the interbank rate at which a bank lends reserve balances to other banks on a short-term basis. The corresponding overnight interbank rate in the US is called the federal funds rate. Such rates can be considered as the banks’ costs of funds.

If an open market purchase is done by the central bank, the rise in aggregate reserves allows banks to have more funds available to lend and borrow. This can push the interbank rate downward, thus lowering the cost of funds. This will help push down all other interest rates paid by households and businesses, such as prime rate and mortgage rate. Open market sales, on the contrary, helps shrink the aggregate reserves, and pull the interest rates upward in the market.

OMO helps the central banks achieve more high-level goals such as stabilising inflation and maximising employment. Open market purchases is an expansionary policy in nature as it stimulates investment through lowering the costs of borrowing. It can fuel up the economy during economic downturns. Open market sales is contractionary in the sense that high interest rates discourage these economic activities. If the inflation is higher than the desired target, a central bank would try to slow down the growth of money supply through open market sales.8